The U.S. Department of Education made a stealthy change on Thursday to President Joe Biden’s loan forgiveness plan, leaving many hopeful borrowers high and dry.

The most affected are likely to be borrowers of Perkins or Federal Family Education Loans, according to NPR.

FFELs are loans given and managed by banks but guaranteed by the federal government. Before the lending program was shut down in 2010, FFELs were a staple of federal student loans.

According to NPR, the number of FFEL borrowers is upward of 4 million.

Prior to September, the DOE’s website had previously said that borrowers of these loans would simply have to consolidate them into federal Direct Loans. This would allow the borrowers to qualify for Biden’s debt forgiveness plan.

“Borrowers with privately held federal student loans can receive this relief by consolidating these loans into the Direct Loan program,” the website reportedly said.

But on Thursday the DOE released new guidance on the policy — a complete reversal of the previous one — and seemingly on the sly.

“Borrowers with federal student loans not held by [the DOE] cannot obtain one-time debt relief by consolidating those loans into direct loans,” according to the DOE.

According to NPR, legal experts believe the reversal had something to do with the legality of “canceling” the debt owed to the banks that issued the FFELs.

These private banks would incur financial losses from Biden’s plan. After all, somebody has to pay the debt.

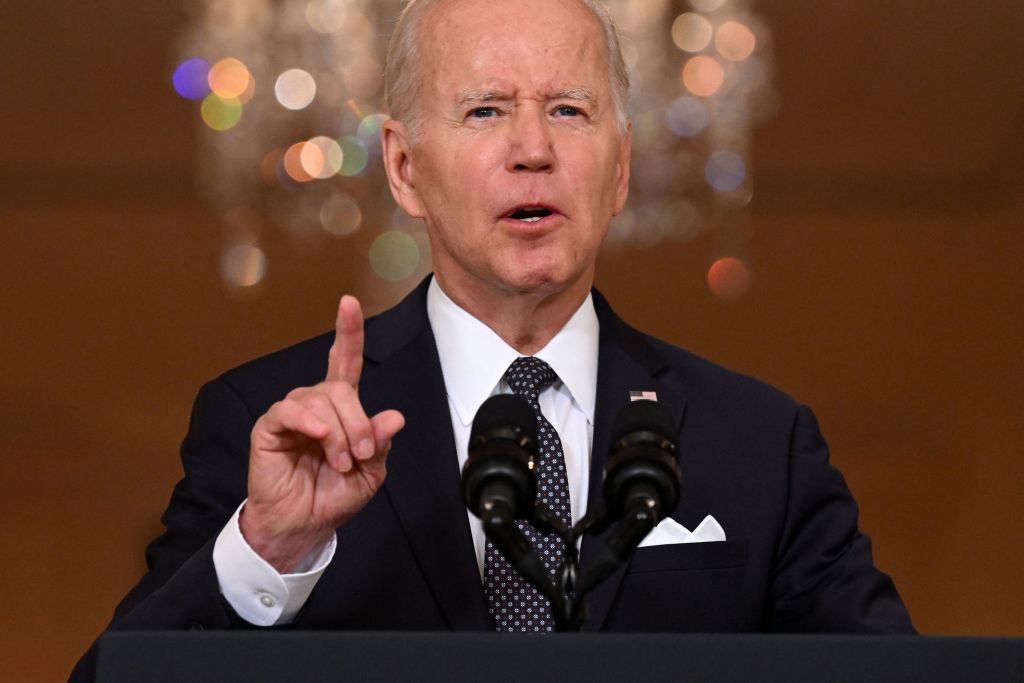

Biden announced the sweeping debt forgiveness plan in August.

In keeping with my campaign promise, my Administration is announcing a plan to give working and middle class families breathing room as they prepare to resume federal student loan payments in January 2023.

I’ll have more details this afternoon. pic.twitter.com/kuZNqoMe4I

— President Biden (@POTUS) August 24, 2022

Already the lawsuits have begun.

On Thursday, attorneys general from six states filed a lawsuit against Biden, the Secretary of Education Miguel Cardona and the Department of Education.

One of the six states filing the suit, Missouri, houses MOHELA, a student loan servicer that lent out FFELs.

According to the complaints listed in the lawsuit, “The consolidation of MOHELA’s FFELP loans harms the entity by depriving it of an asset.”

Additionally, “The consolidation of MOHELA’s FFELP loans harms the entity by depriving it of the ongoing interest payments that those loans generate.”

This article appeared originally on The Western Journal.